Outlook for podcasting includes growing profits, better user experience

Gavin Whitner

In January, Hernan Lopez ended his nearly 20-year career with Fox Networks to go into narrowcasting.

Lopez had overseen Fox International’s 350 channels reaching 1.6 billion customers around the world. Now he is chief executive of a Los Angeles–based podcast startup, Wondery, with Fox as a seed investor.

Lopez sees the change as a return to his earliest media roots — one that positions him for the windfall of advertising sales awaiting those who break in front of the fat pack of podcast startups that have emerged in the past couple of years.

“Television has moved, drastically, to on-demand already,” he told me recently. “Music has moved to on-demand. And audio entertainment is the next one to go.”

What has been a grassroots, artisanal industry — responsible for the creation of the more than 330,000 podcasts now populating the iTunes stores — has gone legit. This year we’ve seen its rapid development beyond cottage industry and experimentation into venture-capital–funded for-profits.

Gimlet Media, Wondery, Panoply and Pineapple Street Media have fully emerged, as Midroll Media, PodcastOne and Audible have further built out their businesses. All are new contenders for the hottest media currency of our time: minutes of spoken audio listening attention.

Americans devote 20 percent of on-demand listening to the spoken word, according to Edison Research, the leading podcast audience survey firm in the U.S. Edison uses telephone, internet and in-person research to track listening habits.

It’s as if the human voice has been rediscovered, via podcasting, with the hours of listening per month — though still poorly measured — clearly growing.

Public radio has nurtured podcasting and played an outsize role in developing its existing audience. Six of the podcast networks that attract the most listening, as measured by Podtrac, are public radio–centric, yet new competition emerges monthly.

Those new for-profit entrants see great opportunity to make money in this emerging business. Public radio “refugees” — among the talented podcast bench built over time by NPR and the larger stations — populate many of the startups, along with others further trained at digital-native companies like BuzzFeed.

The entrepreneurs know they are getting into a nascent industry. It lacks a standard for measuring audience and is just beginning to track actual ad delivery. There’s no Nielsen (as for radio and TV) or comScore (for digital), with Apple functioning as a fairly silent middleman in podcasting. While about 60 percent of podcasts move through Apple via the Podcasts app or iTunes, Apple doesn’t track actual listening.

Yet the recent benchmarks of growth are unmistakable. Consider these:

Yet the recent benchmarks of growth are unmistakable. Consider these:

- Monthly podcast listening increased 24 percent in 2015, according to Edison.

- Podcast advertising revenue, which had been rising at annual rates of 20 percent, jolted up at a 48 percent clip in 2015, according to Bridge Ratings, the firm the ad industry largely cites for market sizing.

- NPR, PodcastOne and Midroll Media are leading the pack in podcast ad sales, according to Bridge. Each took in $10 million or more of an overall estimated pool of $167 million in sales. NPR cites a tenfold increase in ad sales over the last three years.

- For 2017, Bridge Ratings forecasts $207 million in podcast ad revenue.

Even the New York Times, which tested and largely abandoned podcasting years ago, has committed a three-year investment in an ear-budding “audio-on-demand” team of about a half-dozen.

To better understand this arms race for minutes and money, I recently talked with more than three dozen podcast-focused executives. As we look forward to 2017, here are some of the biggest changes and opportunities that they see ahead.

1. Revenue crossover

WNYC’s podcast slate places second in ratings by Podtrac, the download-counting service that debuted this year to some controversy. It has since emerged as the best available yardstick.

WNYC distributes 38 shows, including the well-known Radiolab, Freakonomics Radio and The New Yorker Radio Hour, and its fast-growing traffic is now translating into bigger dollars.

Laura Walker, c.e.o. of WNYC parent New York Public Radio, sees the hockey stick–like growth showing up in her revenue numbers. “Fifty percent of our sponsorship revenue now comes from digital, as opposed to terrestrial, sources,” she says.

That’s a huge crossover point for a portfolio of platforms that includes NYPR’s apps, websites, live streams and podcasts, though podcasting ad sales are driving that digital takeover of the sponsorship line, she says. Radio sponsorship dollars still increase, but both proportion and share have shifted.

Walker still loves revenue from traditional broadcast syndication of the station’s top shows, but she’s found that podcast ad money is better.

“Our experience has been that it’s harder to get radio advertising sponsorship for shows that are on in different times throughout the country, like Radiolab, or … not on consistently, versus getting a podcast,” Walker said. “It’s easier to monetize on podcast if you’re big than it is on national radio.”

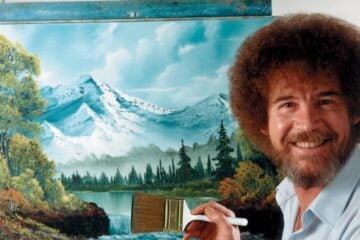

Doctor

WNYC’s crossover number builds on another important finding by Edison Research. Its recent study found that 50 percent of respondents age 12 and older “listened to some sort of online radio in the last week,” a rise from 44 percent last year.

That Edison report follows on the absolute centrality of the smartphone as the point of podcast access. Mobile usage represents podcasting’s most important path for crossover of more advertisers. Now, says Edison, 71 percent of Americans use that hot phone in their pockets to listen to podcasts.

In 2017 look for more crossover numbers. In all audience and revenue measures, all radio companies — commercial and public — increasingly must track this movement of customers and advertising/underwriting budgeting. Look for benchmarks, and then move resources accordingly.

Takeaway: Crossover points — those accomplished and on the horizon — should drive strategic planning for audio. Further, with podcasting such an apparent commercial success, how much will it begin determining public radio investment?

2. Less friction

Stand back from all the podcast market ferment and you see one basic principle: Reduce friction.

Friction — whatever makes it harder for podcast listeners to find and hear their shows, and for advertisers to know the results of their buying — has long been podcasting’s enemy.

Technologists have now solved the basic problem of playability that turned off all but the early adopters.

Still, friction persists in every aspect of the business, from discovering new programs to measuring actual listening, creatively using Facebook and serving current ads.

Companies like Art19 are now getting traction in the industry as they offer podcast networks like Wondery, Midroll Media and — just announced — the New York Times an ad-serving, audience-measuring platform. In fact, by this time next year most of the top podcasts will routinely use “dynamic insertion” ad technology, whereas fewer than 5 percent used it last year. That means fresher ads and better ability to track actual ad listening.

The aim, throughout the startups and the incumbents: Make it all easier. Allow the listeners to find what they want more quickly — and just hit play. Allow advertisers better data on the effectiveness of their spending.

Basic podcast technology has been simple, and that’s why we can count 330,000 podcasts in the iTunes directory. Ultimately, though, as podcasting evolves to share more in common with digital media startups like Vox, Vice and Buzzfeed, it is technology and technologists who will provide the game-changing results.

Takeaway: High-quality differentiated content may be the price of admission to the podcast business, but it is technology, built or licensed, that will reduce friction and drive success.

3. Brand buy-in

General Electric, Esurance and Warner Bros. can be counted among the many big brands that have put money into podcast sponsorship. Yet brand money is still “experimental,” a smaller part of the small-itself $160 million podcast ad ecosystem.

Direct-response advertisers — like Blue Apron, Squarespace, Casper Mattress and Audible — dominate sponsorships. In fact, these advertisers’ bullishness — and willingness to pay $10–$60 cost-per-thousand ad rates — have plowed the field for advertising.

Yet most in the business agree: If podcasters are to take brand money out of digital ad budgets, they’ll have to do more to prove the effectiveness of brand advertising. That’s one reason we see the scurrying to set common download standards, measure more actual listening and ad serving, and do more audience surveys. All this to reach the listeners advertisers lust after: millennials. They make up 38 percent of the podcast listening audience, says Edison Research.

Takeaway: Listen for the names of brand advertisers next year. The more you hear, the more you’ll know the podcast business is moving into its adolescence.

4. Asynchronicity fades.

A decade ago we thought we knew what a podcast was. It was something you downloaded — if you could figure out how — and listened to sometime later.

Now that’s increasingly not the case.

In fact 79 percent of those who download a podcast listen immediately, and 87 percent within 48 hours, says Edison’s Tom Webster, v.p. for strategy and marketing. In the old days, he says, “You would download it. It would save to your hard drive, and you’d move it over to an iPod, which you [now] increasingly don’t have. Then you would listen to it later. Consumer behavior has changed. … Listening immediately has become the dominant paradigm.”

Further, he adds, “The actual percentage of podcasts that are not listened to, or are listened to a week later, is actually pretty small. People do that less and less because there is so much on-demand consumption of podcasts [and] … so much mobile consumption, and mobile broadband is so ubiquitous. [The] concern that people click on a podcast to download it and then never listen to it — it’s really fading into the background.”

Takeaway: Is the difference between audio on demand, including podcasts, and “streaming” more a difference of engineering than one that’s truly meaningful to consumers? NPR One and WNYC’s Discover apps both aim to better mix and match streaming and podcasts. Both NPR and WNYC now see further development and efforts to simplify ahead.

Meanwhile, the startup RadioPublic, an offshoot of longtime podcast tech player Public Radio Exchange, will launch its own “discovery” app this fall.

The Holy Grail for developers is to meet the one-touch, want-it-now expectations of listeners.

5. Next wave of listeners

Jake Shapiro, c.e.o. of RadioPublic, says his new product won’t focus on today’s audience of 57 million monthly podcast listeners. His market target is the 10 million people “who will start listening this year to podcasting, to podcasts on-demand.”

Ten million is a fair estimate of those coming into the podcast sphere, given recent trends.

Right now only 20 percent of the internet-using American population listens to a podcast even once a month. The habits of the next 10 million, 20 million or 30 million listeners aren’t likely to resemble those of the early adopters. In 2015 median podcast usage was five podcasts per week, down from six a year earlier. Look for more casual listeners to join the early market that up to now has been dominated by public radio’s audience.

Call it mainstreaming, and with mainstreaming, the podcast business math changes.

The takeaway: Podcast companies can target two distinct audiences. The first is made up of early adopters, those who tend to be more brand-cognizant and brand-loyal to public radio. They can be encouraged to listen to more podcasts.

The second audience is the newbies — the four in five Americans who aren’t yet listening to podcasts at all. Their habits, programming desires and habituation habits will be tougher to track.

Segmentation is key. Both content creators and distributing networks may be well served by understanding how to satisfy the wants and needs of newer users as well as veterans. That might involve content targeting or simply addressing consumers’ relative familiarity with how to find and regularly get a podcast.

6. Beyond free or paid

How can podcasters pry money directly from listeners so that — unlike many digital news startup companies — they aren’t totally dependent on the whims of ad buyers and philanthropic funders?

They can, of course, put up hard walls: Pay up or you can’t listen. However, with ad money so good right now, podcasters are loath to do that.

Audible’s new $4.95-per-month all-you-can-listen price point for its Channels product gives nonpayers 30 minutes a week to sample its podcasts. Other audio subscription products offer parallel morsels.

Yet expect to see more nuance applied to podcast subscriptions as they work through “access value” questions.

Want to hear the podcast a day early? Want access to the whole back catalog of your favorite podcaster? How about some “bonus” programming? You’ll see lots of those ideas being tested next year.

Subscribers to Wondery’s Sword & Scale program “essentially pay for early access to episodes,” says Lopez.

For public radio and legacy subscription companies like the New York Times, the consumer revenue math is different.

The Times’s business strategy emphasizes one main goal: reader revenue, which now approaches 60 percent of all its revenues. Though the Times’s second effort at podcasting is brand new, expect to see the company tie in podcast listening — maybe providing access to its podcast archives, for instance — with a news subscription at some point.

For public radio the podcasting lure is in reinforcing membership streams. “Membership appeals on the podcast are very similar to radio membership appeals,” says NYPR’s Walker. “We’ve had some great success, particularly with Radiolab and Freakonomics on that, and are building up more.”

Takeaway: For digital news reader subscriptions, as led by the New York Times and Financial Times, a paywall strategy can be a constant work in progress, informed by keen audience development.

While nationally oriented podcast companies can see membership dividends in podcast promotion, regional stations will have to devise other strategies. Those may involve new regional-specific podcasts and/or figuring out new ways to associate local public radio brands with national podcasts. Oregon Public Broadcasting has just licensed WNYC’s Discover in an effort to do just that.

7. Who may follow Audible’s lead?

Venture money has seeded several podcast startups. Small is promising. Yet the looming question is, “What will the big guys do?”

Each of the big audio players, including Apple, Sirius, Spotify and Pandora, has built a big business around sound, but none has taken a big plunge into the podcasting business. In 2017 we’ll see how many follow the example of Amazon’s Audible, which launched its Channels podcast subscription in July.

Maybe the podcast ad and subscriber market is still too small for the big guys. Or maybe they are waiting until the startup networks build traction — and are planning to acquire the winners.

Takeaway: While public radio and podcasts were once synonymous, the allure of the trade now has the potential to draw lots of commercial competition at all ends of the spectrum.

8. Is it the show or the bundle?

As new podcast networks proliferate, they face a key consumer question: How does a listener’s affinity or love of a show translate to a bigger podcast brand?

Clearly, audience-winning podcasts from NPR, WNYC, Boston’s WBUR and PRX’s Radiotopia have burnished the value of their parent brands. Yet it’s unclear by how much.

So much of listener affinity appears to be oriented to a specific show. Can a Wondery, Gimlet or The Slate Group’s Panoply create brand value in their new network names?

“It’s not clear how that’s going to shake out,” says Jacob Weisberg, chairman and editor-in-chief of The Slate Group and a deep observer of digital media. “In the world of books, nobody cares if something is published by Viking or Random House. They care about the author and the book. I think podcasting is going to be more like that.”

“Panoply wants to have a certain reputation for doing high-quality shows and maybe for doing certain kinds of shows,” Weisberg says. “Obviously Radiotopia does that, so I think you’ll have these pools of styles of podcasts. But ultimately, it’s the shows that are the brand, not the publishers.”

Takeaway: We’ll see the limits of word-of-mouth podcaster-to-listener recommendations tested as individual hosts tout their networks’ other programs.

9. Is this local?

As in any digital business, scale often rules. That’s why “getting big fast” is a key goal of all the podcast startups. Scale enables podcasters to attract big audiences that can be monetized by high cost-per-thousand ad rates. The more thousands of listeners the better.

Consequently podcasting has largely been a national audience pursuit. Topics along a range of news, entertainment, cultural and every manner of niche interest drive programming. “Local” as a niche is a tougher go.

Yet we’ve seen early efforts from public broadcasters, including KPCC’s film-based The Frame, KUT’s Texas Standard and WBUR’s CommonHealth. Oregon Public Broadcasting will launch a food and wine podcast, The Four Top, Sept. 12.

One idea here: Create programs that, while regionally based, may find audiences beyond geographic boundaries.

Even if local programming is necessarily limited, how then can public radio stations enjoy more benefits from the podcast boom?

The NPR One app — with its first-screen tip to a local public radio station — is one step in that direction, but only one. Local public media stations can ask themselves: How can we help local listeners discover podcasts of unique interest to them? How can we use the kind of analytics, which leading digital media publishers now use, to better customize offerings and program suggestions to members, their most important listeners?

Takeaway: It’s clear that podcasting will increasingly drive the radio business. Given that understanding, national podcast producers, who also syndicate their programs to local stations, may rewrite their contracts with them. Among the models to be considered: differing cost structures, revenue shares and sharing of data.

10. Talent lab

All Things Considered co-host Kelly McEvers launched her Embedded podcast this spring, and it’s won both critical and audience success.

We can hear and see the double benefit of that launch. The casual style of Embedded now informs McEvers’ work on ATC. Further, ATC directs new audiences to Embedded and presumably other NPR podcasts. Further, podcasting has fueled a youth movement in a public radio system that is concerned with the aging of its audience.

“Podcasting gives us a chance to impact the sound of the network with younger, more conversational, informal voices,” NPR CEO Jarl Mohn told me recently. “Then we can test ideas, and we can also test talent.”

In addition to Embedded, Mohn points to Alt.Latino and Pop Culture Happy Hour as shows that are producing new talent for the network.

Of course talent development can cut both ways. Mohn also realizes that the free and bigger market outside of NPR — many of the startups are peopled by staffers with NPR experience — will inevitably bring new issues of both retention and hiring.

Takeaway: In the wider sense, podcasts offer tryouts for public radio, “minor leagues” for talent development, with candidates given greater responsibility and opportunity to be coached and nurtured. Further, the freer and bigger market for audio talent begins to impact hiring throughout the public radio ecosystem.

Ken Doctor is a media analyst and consultant for his own company, Newsonomics, who employs more than 40 years of experience across a wide range of media. He writes regularly on the business of media change for Politico Media and Harvard’s Nieman Journalism Lab. This analysis is based on research commissioned by Public Media Futures Forum, a project funded by the Wyncote Foundation to support in-depth analyses of strategic challenges facing public media.

[Disclosure – I work for Otto Radio]

“The Holy Grail for developers is to meet the one-touch, want-it-now expectations of listeners.”

For the podcast industry to grow, it has to become a viable alternative to traditional spoken-word audio. My mom listens with great discrimination to at least 2-4 hours of public radio per day. She would be BLOWN AWAY by the quality and topic specificity of the podcasts available today.

We need her and people like her listening to this amazing content…but we’ve got a long wait on our hands if we expect her to invest the time to learn how to curate her own shows and then keep up with new shows as they come online daily. Not when she can just turn on the radio.

As your article so insightfully states, the goal for those hoping to grow this amazing industry has to be to “…allow the listeners to find what they want more quickly — and just hit play.” I would add that it needs to be done in a way that provides (anonymous) listener transparency to attract advertisers and help producers better understand and develop their shows.

That’s what drove the creation of Otto Radio. Frictionless, intelligent, hyper-personalized curation with the push of a button. Otto matches an active map of listener interests and content interactions against an expanding understanding of podcast channel’s topics and episode level subject matter.

Otto provides listeners with podcasts and news stories they love and content producers and advertisers real-time listener analytics. Our platform helps podcasters find their ideal listeners in a “lean back” experience designed to introduce their amazing content to the wider world of terrestrial talk radio listeners.

This idea that podcasting is for listening only is a delusion conjured up, apparently by marketing interests seeking an another advertising medium for what amounts to the online equivalent of radio. Podcasting was NEVER meant to be an audio only broadcast format. The first ever mention of podcasting is contained in a television project proposal to Canada’s CRTC, dated March 31, 2000. The project was called FuturePod. It contemplated a form of specialty-channel broadcasting in thematically-related video “pods”. Podcasting has nothing to do with this or that audio or video diffusion method per se. It is content-related and not medium specific.

[…] seems the world can’t get enough of podcasting, and either can the advertisers. According to Current.org, over $200 million in estimated advertising spending happened in 2017, with projections for even […]

[…] was doing some research and came across a great post by Ken Doctor. He was talking about the radical growth of podcasting. I kind of got, well, […]

[…] growth over the last five years. According to a recent report by Bridge Ratings, ad spend for the 330,000 podcasts in the iTunes directory is expected to increase 27% in 2017 and an additional 30% in 2018 to $250 […]