PBS stations experiment with local sponsorship, membership spots on Passport and video app

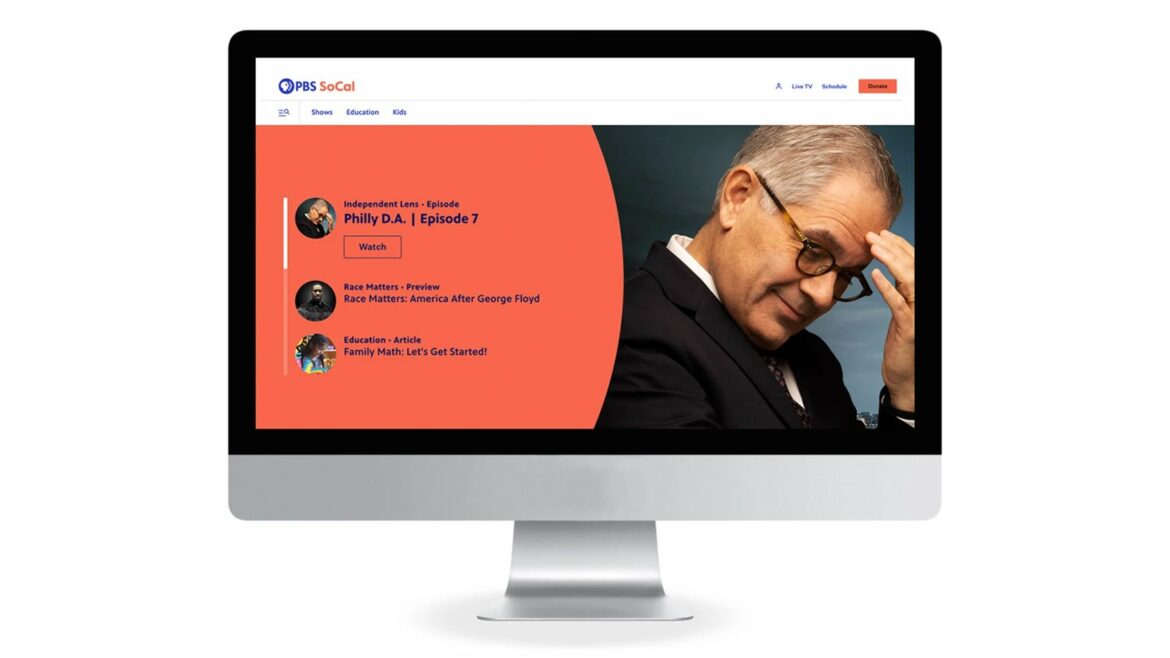

Screenshot

PBS SoCal in Los Angeles is one of several local stations attempting to earn sponsorship revenue and reach audiences via local messages on PBS Passport.

ATLANTA — A year ago, public TV was reeling from declining pledge-drive revenue, yet another signal that viewers were increasingly abandoning linear television for the streaming universe.

Suggestions for a fix included expanding the variety of pledge programs and making technological improvements to PBS’ streaming platforms, a process that is ongoing. Stations also urged PBS to introduce local membership and underwriting messages on the PBS video app and Passport membership service alongside a variety of programs, including national productions.

Before last summer, for example, if PBS SoCal in Los Angeles wanted to earn streaming revenue from local sponsorship spots, they could appear only on one of the station’s own productions, like Variety Studio: Actors on Actors.

PBS listened, and since July 2022 PBS SoCal has been one of five stations to participate in a pilot program to optimize local messages for well-watched programs like Masterpiece. The other stations that joined the program are South Carolina ETV, PBS Reno in Nevada, WFYI in Indianapolis and WNED in Buffalo, N.Y.

Six more stations joined the pilot’s second phase, which started this month: Austin PBS in Texas, Kansas City PBS, PBS Utah, Nebraska Public Media, GBH in Boston and WETA in Washington, D.C. Another batch is expected to be added in late fall or the fourth quarter of this year, according to Jerry Liwanag, VP of fundraising programming for PBS.

Membership leaders from the Public Media Group of Southern California, PBS SoCal’s parent company, led a presentation about how the pilot is faring so far at the Public Media Development and Marketing Conference in Atlanta earlier this month.

Maura Daly Phinney, SVP of member engagement and strategy for the Los Angeles stations, said the preroll spots for phase one of the pilot could be either 15 or 30 seconds and ran before any video on the PBS app that was three minutes or longer.

The beginning of the pilot was “messy,” Phinney said, with technological issues preventing PBS from determining whether spots were being shown to members or nonmembers. But that issue was corrected over time. “It started off a little rough, but we got through,” she said.

Phinney showed an example of a 15-second preroll spot that asked people to become $9-per-month sustainers or donate $108 upfront. “In the first six months, that was the most successful spot — believe it or not, a tote bag,” she said, referring to the thank-you gift they sent sustainers.

Another preroll message the station shared was a 30-second spot centered on the work of Los Angeles–based artist Daisuke Okamoto. PBS SoCal asked people to donate in exchange for a tote bag or fleece-hooded sweatshirt that featured Okamoto’s illustrations. That campaign ran from February to the end of April.

Between July 2022 and the end of June, preroll spots on Passport and the video app for PBS SoCal achieved 6.4 million total impressions, Phinney said. Four million were for underwriting, and 2.4 million were for membership. The station made $8,400 in revenue from the spots. “That’s basically what one good pledge show makes in Los Angeles, once, in an airing, so we’re not talking about serious money yet,” she said. “But I’ve come around to thinking about this not as a total disaster.”

“Looking forward, I have come to think of this now as a way to get local messaging into the streaming universe to the people in your market to remind them that there is a local PBS station in your market,” she said. “So we’re leaning heavily on thank-you spots, awareness spots, Passport spots. You shouldn’t go into this thinking you’re going to make a ton of money.”

When the pilot started, PBS SoCal didn’t charge sponsors, said Robert Dea, VP of corporate underwriting. “I’m not charging … because it’s a test,” Dea said. “I don’t really know what can be delivered.”

Dea said he ran 20 underwriting campaigns that averaged 332,000 average monthly impressions. He plans to start charging underwriters this fall at $20 to $25 cost per minute for a maximum of 25 campaigns with 15-second preroll spots.

One lesson he learned during the pilot is that messages that aired run of schedule — across a variety of dayparts, demographics and programs — fared better than messages that were restricted to certain genres or groups of shows.

Dea said viewers complained about repeatedly seeing the same underwriting messages. One way to solve this, Dea said, would be to have PBS improve the behind-the-scenes technology to spread out messages so that audiences don’t see the same ones when they binge videos.

“It’s a fine line. You want the repetition so people see the spots enough that it sinks in. Everybody knows one time isn’t enough,” Phinney said. “In a perfect world, when the programming gets more sophisticated, we should at some point be able to know the exact viewer that’s watching and how many times.” That would allow the video app to prioritize showing certain messages to viewers who haven’t seen them.

One public TV staffer asked how PBS stations should handle FCC guidelines for what kinds of sponsorship messages they can place on the video app.

“Do you have a lawyer?” Dea responded in jest. He said that digital underwriting has fewer restrictions, though stations should study the caveats before making decisions.

Phinney cautioned against messages that stray too far from public TV’s mission. “Don’t put anything on the app that you wouldn’t put on television,” she said. “This is our brand. This is the most powerful thing we have. That trust, you don’t want to just mess with it just because you can.”