January CDP Index: Fourth quarter sees rally for high-dollar gifts, new radio donors

There is a lot of good news in the Public Media Index for the fourth quarter of 2024, with the biggest story being a 5.4% increase in new donors for Radio compared to the same quarter of 2023. We are going to take a closer look at new donor results for calendar year 2024 below. But first, we’ll start with a recap of other key findings for this fourth quarter.

The Membership Revenue Index for the three-month period ending Dec. 31 had a 3% increase compared to the same three-month period in 2023 — the largest increase in revenue since the first quarter of the year. TV and Joint licensees saw an increase in membership revenue of 2.3%. Radio had an increase in revenue of 4.1% — the third revenue increase in a row for Radio in our monthly reporting. Across organizations by size, both the smallest (less than 15,000 active donors) and the largest (40,000 or more active donors) had revenue growth exceeding 3%. Organizations with 15,000–40,000 donors saw a more modest 1.1% increase in revenue in this period.

The High-Dollar Gifts Index saw an increase in gifts of $500 or more of 6.7% and was once again a key driver for overall growth in revenue. Both TV/Joint and Radio organizations experienced an increase in high-dollar gift counts. TV/Joint licensees had a 6.2% increase in $500+ gifts, and Radio outperformed the overall index with an 8.7% increase. Small and large organizations both experienced approximately an 8% increase in larger gifts, while mid-sized programs had gains of nearly 4%.

Calendar year 2024 results

A strong fourth quarter reversed prior monthly trends to end the year on a higher than anticipated note. Overall revenue increased by 3.2% in 2024 compared to the previous year. A 4.5% increase in high-dollar gifts was the primary driver for overall results, with support from sustainer giving at TV/Joint licensees.

In the New Donor Index, Radio had a strong fourth quarter with 5.2% growth over the same quarter in 2023. However, full-year results revealed declines for both Radio and TV/Joint licensees of 9.2% for new donors.

Using CDP Insights reporting, we took a closer look at four key channels for new donor acquisition: pledge, digital, direct mail and Passport.

Pledge

In 2020, 40% of all new donors were acquired during pledge drives. By 2024, that figure has declined to 30% for the system, though Radio-only organizations still rely on pledge for more than half of all their new donors.

As audiences have shifted in how they are consuming content, on-air fundraising has taken the biggest hit. Not since 2020 have we experienced any year-over-year increases in new donors acquired by pledge for TV/Joint licensees or Radio. Fortunately, more than a third of all pledge-acquired donors make sustainer gifts with an increasing 36-month lifetime value that neared $284 in 2024.

Digital

Digital fundraising (giving online outside of pledge drives and excluding Passport) accounted for nearly 15% of all new public media donors in 2024, down just slightly from the 16% peak in 2020, when the system experienced a remarkable 37% year-over-year increase in digital acquisition of new donors. Though 2021 and 2022 saw steep declines in new donors acquired online, 2023 and 2024 saw some stabilization in the number of donors acquired online as organizations continue to invest in online content delivery and fundraising.

Direct mail

Outside of some lifts during the pandemic, direct-mail acquisition has been declining for many years as donors turn to other channels to make their gifts — notably online. Organizations lean into this donor behavior by providing QR codes and URLs in their direct-mail pieces to make it easy for donors, despite the fact that these practices muddy attribution. Even with this shift in gift attribution, direct-mail acquisition continues to be measurably effective, with a median 10% of all new donors attributed to direct mail at the organizations that use it (139 total organizations in the most recent report). And it continues to be profitable, with a $165 36-month lifetime value.

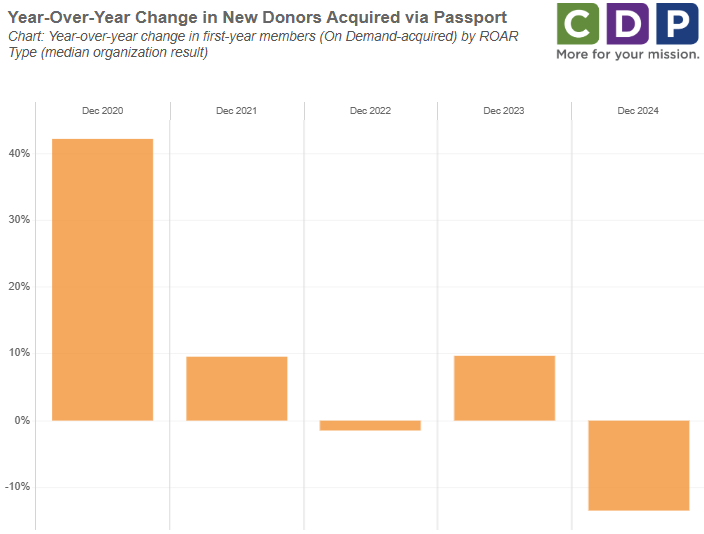

Passport

The calendar year 2024 was not the strongest year for Passport usage or new donor acquisition. Though the number of users did increase year-over-year by nearly 2%, this was much more modest growth than in previous years. Post-pandemic, Passport usage had increased by approximately 15% each year until 2024.

This, of course, is reflected in new donor acquisition. Though the share of new TV/Joint donors acquired via Passport remains very strong at 43% (up from 29% in 2020), the median decline in the number of new donors acquired by Passport was 13.6% in 2024.

Though these donors do have a lower dollar-level entry point and ongoing donor value than other acquisition channels ($154 at 36 months), 64% of these donors make sustaining gifts, helping maintain file stability.

Look for the complete CDP State of Public Media Fundraising report for 2024 in March.

This monthly report on the fundraising performance of public media stations is provided through an editorial collaboration between Current and Contributor Development Partnership (CDP). The collaboration draws from CDP’s National Reference File, which collects monthly membership and revenue data from more than 170 public media stations. (Read more about the methodology.)

Deb Ashmore joined CDP as Analytics Strategist in September 2023. With more than 25 years of experience in the nonprofit sector and public media fundraising, she is passionate about working to help clients understand their fundraising data to inform strategies for long-term file health and growth. Her previous public media experience includes 10 years as director of individual giving for WXPN in Philadelphia.