July CDP Index: New donor growth reaches highest level since 2021

While the loss of federal funding is devastating news for the public media system, the audience response is anything but. As the hits keep coming, public media support has steadily and rapidly increased each month since January across all key performance indicators and for all organizational breakouts by size and licensee type.

Both our most loyal contributors and folks who have never supported their local public media organization have shown up. Median growth in revenue and new donors in the most recent three-month period — the final quarter of fiscal year 2025 for many — was the strongest since July 2021.

The Membership Revenue Index showed a 24.1% increase for the three-month period ending June 30 compared to the same three months in 2024, with lifts near or greater than 20% for both Radio-only organizations and TV/Joint. Comparing a full year of data ending June 30 to a full year ending June 30, 2024, revenues increased 7.2% at the median for the system.

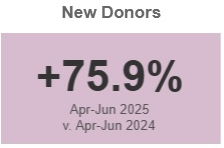

The New Donor Index has been knocking our socks off for the last few report periods, and this most recent period is no exception. Over the three-month period, the median increase for all public media organizations was 75.9% compared to the same period last year. Radio growth for new donors reached 162.6% in this three-month index, with TV/Joint reporting a 65.3% increase.

Of the 174 organizations that submitted data this month, all but 15 had growth in new donors that exceeded 10%.

The strong performance in new donor growth during this intense first half of 2025 lifted results for the entire 12-month period by 7.8%. Radio had a greater 12-month increase at almost 20%; however, TV/Joint licenses achieved a strong 7% gain over the 12-month period.

Increasing investment in midlevel and major-giving efforts has driven ongoing growth for the High-Dollar Gifts Index, tracking gifts of $500 or more, for many years. The funding crisis has also provided a lift in this steady performer, with growth in the last three months of 66.3%. TV/Joint licensees had gains of 67.1%, and Radio saw growth of 56.6%.

High-dollar growth was strongest for our largest organizations (those with 40,000+ active donors) at 73.4%. This strong growth in high-dollar gifts is a primary driver for the stronger revenue growth of 26.5% for these organizations. However, high-dollar gifts grew by a hefty 58% for organizations with fewer than 40,000 active donors, driving revenue growth that exceeded 20%.

The vote to rescind funding and the subsequent announcement that CPB is winding down operations were heartbreaking. But the enormous show of support from public media audiences and the reasoned messages of strength and solidarity from industry leaders has been inspiring. Defunded but not defeated, indeed.

A webinar to review the 12-month performance through June with a deep dive into these new “crisis” donors will be held Aug. 20, and a State of Fundraising report for fiscal year 2025 is forthcoming.

This monthly report on the fundraising performance of public media stations is provided through an editorial collaboration between Current and Contributor Development Partnership (CDP). The collaboration draws from CDP’s National Reference File, which collects monthly membership and revenue data from more than 170 public media stations. (Read more about the methodology.)

Deb Ashmore joined CDP as Analytics Strategist in September 2023. With more than 25 years of experience in the nonprofit sector and public media fundraising, she is passionate about working to help clients understand their fundraising data to inform strategies for long-term file health and growth. Her previous public media experience includes 10 years as director of individual giving for WXPN in Philadelphia.