Growing costs, falling sponsorship fuel wave of layoffs in pubmedia

AndreyPopov / iStock

Colorado Public Radio CEO Stewart Vanderwilt recalled a lesson from his mother while talking about recent layoffs in public media.

His mom would say if you sat down with your neighbor and put everyone’s problems on the table, you would probably be happy to have your family’s problems back, Vanderwilt said.

March layoffs at CPR are part of a wave of job cuts that have swept public media over the last year. Current has tracked more than 400 jobs lost to layoffs or buyouts since March 2023, including at operations as different as NPR, Chicago Public Media, GBH in Boston and WBHM in Birmingham, Ala.

“We have organizations like CPR — our issue is a slowing of growth on the revenue side,” Vanderwilt said. “You have other organizations that have seen steep declines.”

Media layoffs

According to CPB, 18,928 people worked at Community Service Grant–qualified stations in 2023. That was up 4.7% from 18,077 in 2022 but down 1.5% from 19,226 in 2020.

Carlos Barrionuevo, a director with Public Media Co., contrasted the 400 job losses Current has tracked to the deeper cuts in commercial media.

“The … announced layoffs [in public media] are certainly not at the scale that we’re seeing in the rest of media,” Barrionuevo said.

Digital, broadcast and print news saw 2,239 layoffs announced just in January through May of this year, according to a report from career transition specialists Challenger, Gray & Christmas Inc. There were 3,087 news cuts in all of 2023.

Barrionuevo said the situation is painful and certainly frightening for people who have expected a certain level of stability and growth. But he pointed out the positives of public media not being owned by private equity and still being trusted by its audience.

“This should not be a total doom-and-gloom story,” Barrionuevo said.

Revenue growth softens

CPR’s cuts were announced in March with 15 people in its podcast unit, on-site performance studio and music staff being laid off. But Vanderwilt said that was reduced to 12 as three of the employees took on new roles.

“We made it clear that first and foremost, CPR is a journalistic organization,” Vanderwilt said of the station’s priorities when it realized it needed a restructuring.

The issue, Vanderwilt said, was revenue not growing at the same pace as expenses.

CPR’s operating deficit grew to $2.3 million in the 2023 fiscal year, up from $1.3 million in 2022, according to a financial statement on the station’s website.

There were 185 positions at CPR in 2022, up from 128 in 2018, according to CPR Marketing and Communications Senior Specialist Clara Shelton.

“We’re a larger organization than we were five years ago,” said Vanderwilt, adding that a new compensation structure also contributed to increased expenses.

Meanwhile, the station’s revenue growth has slowed. CPR saw consistent growth at an average of 7% for more than 10 years before that slowed in the 2023 fiscal year and continued to do so in 2024, according to Shelton.

Vanderwilt said a decline in broadcast’s cume and the time that audience spends listening creates a two-part problem for membership growth.

“With fewer people coming in, and less consumption by those who do, growth becomes an even harder challenge,” Vanderwilt said. “Audience growth needs collective attention.”

Multiple stations have cited revenue growth not keeping up with cost increases as a reason for job cuts. At KUOW in Seattle, where eight people were laid off in April, total expenses rose nearly 17% from about $20.6 million in 2022 to $24.1 million in 2023, Meanwhile, total revenue increased only about 1.9% from $21.3 million in 2022 to $21.7 million in 2023, according to financial statements.

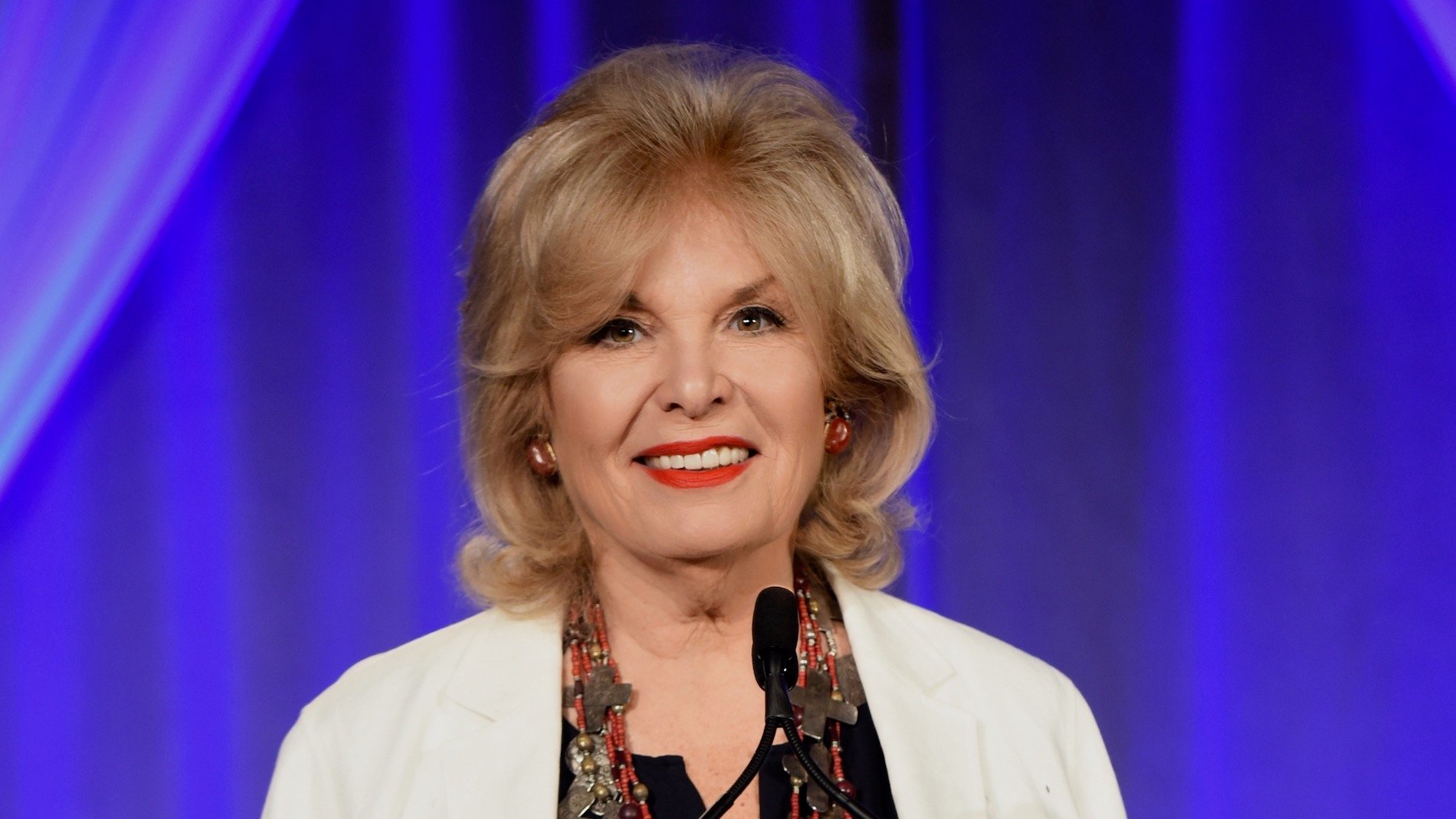

For 2024, expenses were estimated to rise to $24.5 million, with revenue dipping slightly to $21.6 million, GM Caryn G. Mathes previously told Current.

KUOW’s higher expenses were due to inflation, higher salaries, having a fully staffed organization unlike during the coronavirus pandemic, and investments in digital infrastructure and new “on-demand audio content,” Mathes said.

A CPB State of the System report released in June revealed that direct revenue for radio had increased $4 million, or just 0.2%, from FY 22 to FY23, while direct revenue for television fell $37 million, a 1.9% drop.

Expenses, meanwhile, went up $70 million for radio, or more than 4.8%, and television’s costs jumped by $143 million, or 7.7%, the report shows.

CPB also found job openings and hirings had declined, with 3,317 openings in FY23 compared to 4,020 in FY22. In FY23, stations hired 2,048 people, down from 2,469 in FY22.

Sponsorship challenges

At CPR, national sponsorship fell 40% throughout 2023, according to Shelton.

“Most of the stations who have had layoffs, it’s partially because of sponsorships,” said Jim Taszarek, president and founder of Market Enginuity.

Market Enginuity handles sponsorship for 15 public media stations. Taszarek could not reveal specific numbers about the individual stations.

He said total revenue from sponsorship sales across all 15 stations was down 2.7% from July 2023 through March compared to the same prior period. That was despite eight of the stations showing growth during that time.

“There was an ad recession that ended last summer. Advertising is growing again. Broadcasting is not growing like it did. The dynamics have changed,” Taszarek said. “We are improving. It’s just not improving to the big growth rates of the past.”

Sponsors are following audiences to digital TV and audio such as YouTube, Netflix, podcasts and digital radio streaming, Taszarek said. He added that another move is to retail advertising networks, such as advertising on Amazon.

Advertisers also want more performance-based advertising where return on investment can be tracked, Taszarek said, instead of the brand advertising that public media offers.

One bright spot Taszarek sees is newsletters.

“Newsletters serve the audience. Newsletters serve membership,” he said. “It also allows you to generate more sponsorship revenue.”

‘Not unique’

Last March, WBHM in Birmingham, Ala., laid off four employees.

WBHM reported an operating loss of more than $626,000 in 2022 following operating losses of more than $373,000 in 2021 and $335,000 in 2020, a financial statement shows.

“It really has become a perfect storm post-pandemic, with a lot of things coinciding,” said Executive Director Will Dahlberg. “There’s no easy solution to plug all the holes in the dam at once.”

He said WBHM has seen a steep decline in member revenue, particularly as the station acquires fewer new members during fund drives.

That occurred in part because listening habits changed during the pandemic, Dahlberg said, with people driving less.

He added sponsorship was already more challenging in conservative states and the Southeast than other places, but now that situation is even harder.

“We’ve seen an acceleration in the number of businesses who traditional radio sponsorship isn't enough for them like it has been,” Dahlberg said.

The hundreds of layoffs in the year since WBHM’s cuts have offered some perspective to Dahlberg.

“My heart breaks for every station that I see that is making these decisions now,” Dahlberg said. “I think it’s clearer to us that what we went through and the systemic problems are not unique to us in retrospect.”

Still, Dahlberg isn’t exactly optimistic when looking into his crystal ball.

“I’m really worried about what the future of public media looks like and our survivability,” Dahlberg said. “I also worry about our ability to retain really good employees, especially younger and more diverse ones, at this time.”

Newsletters are important and so are membership events.

Also, the broadcast audience is still loyal if stations are loyal to it. E.g. if you’re a Classical Music station don’t switch to News/Talk.

Is the chart “Layoffs and buyouts in public media, by month” based on the number of stations or the number of jobs/people affected? It has to be number of jobs right?