CPB’s first post-pandemic analysis of stations finds stagnating radio revenue, drop in TV income

Dru Sefton / Current

CPB’s first State of the System report since the waning of the COVID-19 pandemic found stagnating radio revenues and a decline in TV revenue.

Fiscal year 2023 revenue among all stations declined $11 million from FY22, or 0.4%, according to CPB’s analysis. The findings were presented Wednesday at the Public Media Business Association’s annual conference in St. Louis.

“The headline this year is really one of stability for the majority of the system, but as we get into the details, you will see a post-pandemic view that points to what’s probably a ‘new normal,’ including a reset in individual giving, increased expenses across the board and some staff reductions,” said CPB VP of System Strategies Beth Walsh, who co-led the session with Moustapha Abdul, CPB’s senior director of station and system analysis.

“We know that the pandemic accelerated changes in viewing and listening habits,” Walsh added, noting that the shift away from broadcast platforms is affecting public media’s ability to raise money through underwriting and individual donors.

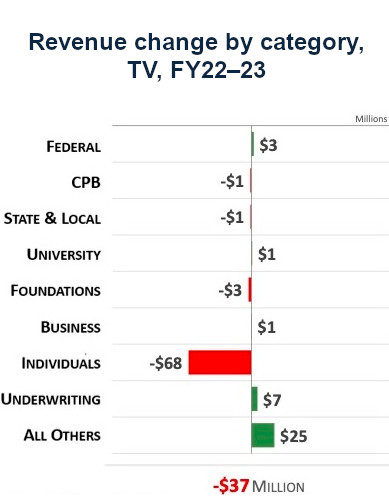

Radio’s total direct revenue — revenue that excludes royalties, interest and dividends, and realized and unrealized gains on investments and assets — increased $4 million, or 0.2%, in fiscal year 2023. Television’s total direct revenue decreased by $37 million, or 2%, over the same period.

Individual giving grew $20 million for radio, though the number of individual contributors declined from 3.13 million to 3.07 million. Individual donations decreased by $68 million for TV, while the number of donors held steady at 3.63 million.

CPB’s analysis also showed drops in job openings and hirings at stations. There were 4,020 job openings in FY22 and 3,317 in FY23. Meanwhile, stations made 2,469 hires in fiscal FY22, which dropped to 2,048 in FY23.

I would be interested to know (if anyone happens to have any relevant info about this) whether or not the issue of foundations and individuals wanting more of a say in how their dollars are spent, vis a vis corporate underwriting which usually has a “firewall” specifically blocking the sponsor from having any say at all in how the station spends that money.

A. Is that really “a thing”? and B: If it is a thing, is that making things even worse for stations as they struggle with donors/foundations who almost never want their money going towards existing operating expenses, and instead want it to fund new things…right at a time when stations can least afford adding any new expenses to their balancesheets?