How the pandemic changed public media’s financial outlook

Nuthawut Somsuk / iStock

To understand how the disruptions of COVID-19 affected public media’s financial health, Public Media Company analyzed CPB’s station revenue data to identify changes in public radio and television finances since the onset of the pandemic.

Our analysis looked at Annual Financial Reports of 461 CPB-funded stations through fiscal year 2021, the latest available dataset. Only stations that consistently submitted AFR data to CPB and reported nonfederal financial support in 2011, 2016 and 2021 were included. The breakdown of stations that met these criteria was 303 radio grantees and 158 TV grantees.

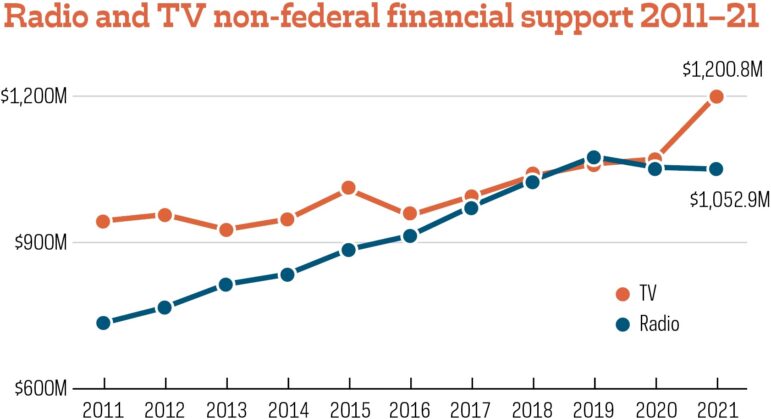

The topline trend shows continued public media growth: NFFS, which includes fundraising revenues and support from state governments and university licensees, reached a new peak in 2021, nearly $2.2 billion. The total surpassed 2019’s prepandemic NFFS by $118 million. Looking at the 10-year trend, total NFFS grew 34%, or by $570 million, from 2011 to 2021.

The data also showed differences across public radio and television stations. Public radio NFFS declined between 2019 and 2021, largely due to drops in underwriting revenue, but public television grew during the same period. Continuing a long-term trend, NFFS of small stations also declined, much of it driven by cuts in institutional support.

We also analyzed stations’ total revenues, a larger dataset that includes funding from CPB and other sources. Revenues in 2021 approached $4.1 billion, a 26% increase from 2020. This growth is likely to be short-lived for two reasons: Federal pandemic relief funds boosted total revenues, and stock market gains drove massive growth in stations’ endowments. As every investor who watched the market in 2022 knows, stock values eroded last year. Endowment gains from 2021 very likely eroded too — and we won’t know by how much until financial reports from fiscal 2022 are available later this year.

Financial analyses of public media stations typically focus on NFFS rather than total revenues. That’s because NFFS tracks the revenue sources that are within the control of stations, including individual giving, sponsorship and institutional support.

Here are three more significant takeaways from the analysis:

Public radio’s total NFFS declined in both FY 2020 and 2021, marking the first time in recent history that public radio has experienced year-over-year decreases.

The downturn in sponsorship sales that began in 2020 continued for public radio in 2021, while public television bucked that trend. TV stations began to chart a recovery toward prepandemic sponsorship levels.

Public television also outpaced radio in major-gift fundraising: Its revenues grew by 36% between 2019 and 2021, compared with radio’s 24% growth. Increases in Passport subscriptions, which were driven by widespread adoption of streaming during COVID lockdowns, boosted public television membership fundraising. Total revenues grew 18% from 2019 to 2021 for public TV. Radio’s membership revenues gained 9% during the same period.

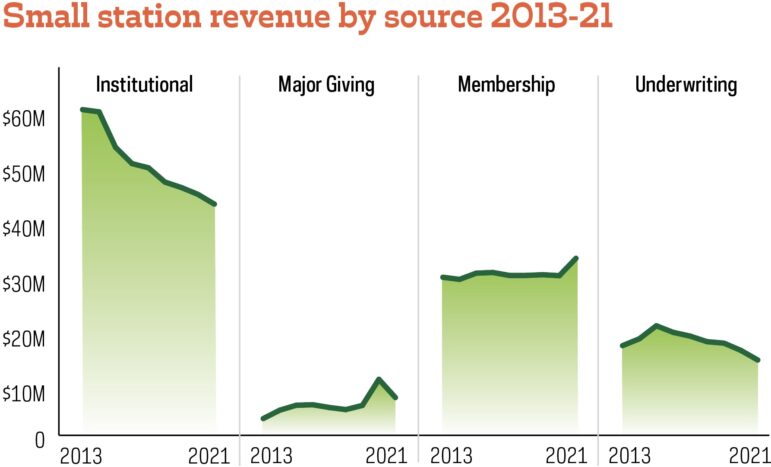

The pandemic did not change the financial squeeze that’s affecting small stations.

Small public media stations are falling further behind larger ones financially.

To analyze financial performance based on station size, PMC uses total NFFS revenues to divide radio and television stations into three tiers: small, medium and large. In FY21, small radio stations earned less than $800,000 in NFFS; small TV stations earned less than $2 million. NFFS totals of large radio stations topped $2.3 million, while large TV stations earned more than $6 million.

When we compared financial performance data based on station size from 2019 to 2021, we found that large public media stations grew their NFFS by 9%, while the smallest saw an NFFS drop of 3%. The 10-year trend is starker: From 2011 to 2021, NFFS for the largest stations grew 46%; for the smallest stations, it declined 13%.

An ongoing decline in institutional support for small stations is one key driver of this trend. Direct and indirect assistance from universities, states and school districts is a large and critical component of small station revenue, and it’s been hit hard. Since 2013, institutional support for small stations has declined 28%. Meanwhile, institutional support for large stations grew by 12%.

In response to the challenges faced by small stations, Public Media Company launched the Impact for All initiative in 2021. We’re gearing up to work with a new group of stations this year. I’ll be sharing details about our plans — and take a deeper dive into the financial trends and challenges of small stations — in another commentary for Current.

Budget cuts can have long-lasting effects on future financial performance.

During the Great Recession, public television stations made significant cuts in their fundraising and content budgets. These may have contributed to public television’s struggle to recover financially after the recession ended. In 2021, public TV stations spent less on content and fundraising than they did in 2008. And despite recent growth in public TV revenues, total NFFS for public television has yet to surpass its 2008 total of $1.204 billion.

Public radio stations didn’t cut their spending on content and fundraising during the Great Recession, and their revenues continued to grow annually — until COVID. During the pandemic, radio stations made significant expense reductions. Between 2019 and 2021, radio stations cut their expenses in fundraising by 12%, content by 3% and underwriting/grants by 11%. Hopefully, these cost-cutting decisions won’t result in a repeat of TV’s Great Recession experience.

The data in this analysis combines financial reporting by all of the public radio and television stations that are funded by CPB and consistently provide annual financial reports to CPB. An individual station’s financial performance may differ from systemwide trends.

As managing director of Public Media Company, Steve Holmes has extensive experience with developing financial analyses and strategic insights for public media stations to increase local impact and long-term sustainability. Before joining PMC, he was senior director, strategy and insight, for PBS. If you have questions about this analysis or other data, contact him at steve@publicmedia.co.