Radio stations have been gaining financial strength — and there’s room for more growth

Khongtham / Shutterstock

In a four-part series, the co-authors of “The Growing Strength of Public Media Local Journalism” have excerpted their findings for the Current readership. In the report, the co-authors make the case for why public media stations are well positioned to play a meaningful role in efforts to rebuild local news. You can find the full report, including an introduction, methodology and report background, here. This research was made possible through the generous support of the Wyncote Foundation, for which we are grateful.

The co-authors will discuss their research Thursday at a free virtual Public Radio Program Directors conference, the PRCC Summit. You can learn more and sign up here.

The Growing Financial Strength of Local Public Radio

The growth of public media is best understood through examining the increasing financial strength of the local organizations that own and run public radio signals. (We refer to these organizations as “licensees” and their broadcast signals as “stations.”)

News-focused public radio licensees have enjoyed stable and growing revenue across the decade. According to an analysis performed by one of our authors, total direct revenue for the largest 123 news-focused public radio licensees has grown steadily, from roughly $678 million in FY2009 to just under $1 billion in FY2020.1 More than 40% of FY2020 revenue in this group came from individual giving (a term that combines small and major gifts), while underwriting accounted for about 23% of revenue that year. These two categories represented the largest streams of revenue for public stations in FY2020.

Americans have been giving to public radio in greater numbers across the past decade. If we look more broadly at the entire system of public radio stations (including all news, music, and eclectic-formatted stations), the donor base and individual giving capacity for public radio stations continues to grow, even in the face of increasing competition for media donations. In FY2020, according to CPB annual financial reports analyzed by the Station Resource Group, individual giving came to nearly $600 million across the entire set of public radio stations, from a donor base of about 3.5 million. By comparison, in FY2009, the entire set of public radio stations had a base of just 2.5 million donors who provided just under $400 million.2

The last five years have seen an increase in giving levels in the public radio donor base. Available data suggest that small-level, mid-level, and major-level givers have all increased their support to public radio in the last five years, according to a detailed analysis of giving patterns in 54 public radio stations by Greater Public.3 Small-level givers are those who donate up to $249 per year. Mid-level givers are those who donate $250 to $999, and major-level givers are those who give $1,000 to $9,999. Greater Public found that the size of each cohort of small-level, mid-level, and major-level givers increased from 2016 to 2020, and the amount that the individuals were giving in each cohort also increased. Relatedly, a 2021 report prepared by Blackbaud’s Target Analytics of 63 stations found that the revenue per donor increased from $150 in 2016 to $175 in 2020.4

Public radio has enjoyed an increase in both sustainers (those who give monthly) and major donors over the last five years. According to the same detailed analysis of giving patterns in 54 public radio stations performed by Greater Public, the percentage of public radio donors who are sustaining members grew from approximately 500,000 in 2016 to approximately 700,000 in 2020. In 2016, about 20 stations surveyed by Greater Public reported that at least half of their donors were providing support through sustainer programs. By 2020, nearly 40 stations reported that at least half of their givers were sustainers.

These two reports documenting the expansion of sustainer-donors provide additional evidence of increased financial capacity in public media. Sustaining donors renew at much higher rates than single-gift annual donors and often contribute at higher levels of annual giving. So the growth of sustainers tells us the donor files of public radio licensees are likely to be strong, durable financial assets in the near and medium term.

Major giving and planned giving are poised for expansion in public radio. The public media support organization Greater Public has been leading an initiative to encourage public radio licensees to expand their major giving and planned giving programs. Among the licensee members in their initiative, Greater Public found in April 2021 that medium-performing licensees in the cohort were receiving around $2 million per year in major gifts, high-performing licensees were receiving $7.6 million and very high-performing licensees, $8.4 million. Based on projections of giving capacity in the donor base, Greater Public set expansion expectations of more than double those amounts in the next five years: $4.7 million for medium-performing licensees and $19 million for high-performing and very high-performing licensees.5

More growth potential remains across the public radio system. While there is a top tier of very successful news-focused public media licensees, we see an opportunity for more licensees to capitalize on their strong positions in their local markets. For example, of the 123 news-focused public radio licensees analyzed by one of our authors, seven earned revenue of more than $25 million each in FY2020, with another 15 licensees earning more than $10 million each. These midsize news-focused licensees have room to grow. Beyond the set of news-focused licensees, there is a long tail of smaller licensees with revenue earnings of less than $10 million. Most CPB-funded radio licensees fall into this third category, and there is room for growth here, too.

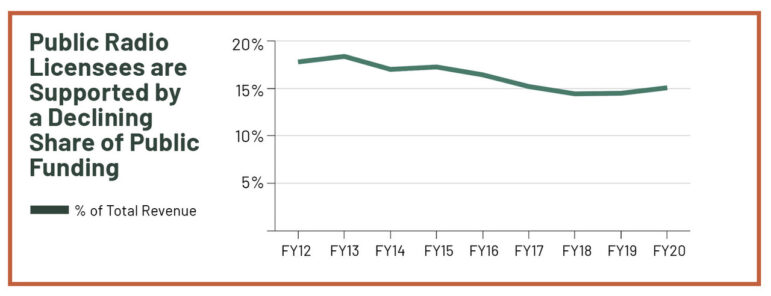

News-focused public radio licensees are supported by a declining share of public funding. According to an analysis performed by one of our authors of the largest 123 news-focused public radio licensees, the share of public dollars supporting these licensees (in the form of CPB funding, state funding, and public institutional funds) has declined as their other revenue streams have expanded. This trend among the largest news-focused licensees, however, does not shed light on the inequalities among station owners. Smaller stations, typically those serving sparsely populated rural areas, are supported by a much larger share of federal dollars than large stations serving populous areas.

News-focused public radio licensees are spending more on content than fundraising. As revenue has grown in the sector, the data we collected suggest news-focused public radio licensees are spending more resources on producing content and expanding news capacity than on fundraising. In our analysis of 123 news-focused public radio licensees, we found that these licensees spent $640.2 million directly on content production in FY2020. If we account for the full cost of content production, including promotion and delivery, that figure rises to $712.4 million or 69% of total revenues. By comparison, the combined cost of fundraising for licensees’ “generated income” was $202.4 million in 2020, representing 19% of total FY2020 revenues. In other words, as revenues in the system have expanded, public radio stations are spending 3.52 times more on content and its delivery than they are spending on fundraising.

Part II of the excerpted report, to be published Thursday, will explore the news capacity of public media local journalism.

Elizabeth Hansen Shapiro is CEO of the National Trust for Local News. From 2020–22, she was a Senior Research Fellow at the Tow Center for Digital Journalism at Columbia Journalism School. Previously, Elizabeth led news sustainability research at the Shorenstein Center on Media, Politics, and Public Policy at the Harvard Kennedy School. She was the Research Director for the Membership Puzzle Project’s Guide to Membership and the Public Media Mergers Project. She received her Ph.D. in Organizational Behavior from Harvard Business School.

Mark Fuerst is founder of Innovation4Media (I4M), which has worked with public media stations, networks and association leaders to understand the public service and business opportunities of digital media. Since 2012, Mark has managed the Wyncote Foundation-supported Public Media Futures Project, to study the changing media landscape. He was co-founder and Executive Director of the Integrated Media Association (IMA). From 1986 to 1997, Mark was General Manager of WXPN-FM in Philadelphia, the station that developed the AAA music format for public radio. He was co-creator and executive producer of World Café, NPR’s AAA music program that airs on 581 stations.

Caroline Porter is a media strategist and researcher. She serves as Director of Impact and Strategic Partnerships at the National Trust for Local News. Caroline worked as a staff reporter for The Wall Street Journal in the Chicago and Los Angeles bureaus and served as an adjunct lecturer at Northwestern University’s Medill School. As a Fulbright Scholar in Northern Ireland, Caroline researched the role of media in the post-conflict region and earned a master’s degree with honors from Ulster University. You can find her on Twitter at @carolineporter.

- Analysis performed by Mark Fuerst in Jan. 2022 of 123 public radio licensees. ^

- Data provided by Station Resource Group’s Public Radio Overview, Nov. 2021. ^

- Data provided by Greater Public’s Benchmarks for Public Radio Fundraising, July 2021. ^

- Data provided by Blackbaud’s Target Analytics, July 2021. ^

- Data provided by Greater Public’s Building a Sustainable Major Giving Program, April 2021. ^