Downton Abbey once again helps generate big budget surplus for PBS

PBS closed its books on fiscal 2013 with an extra $24.5 million — more than twice the $11 million surplus that bolstered its bottom line in FY12.

Downton Abbey, the Masterpiece megahit, continues to feed the coffers of the public TV system via distribution deals. From left, Matt Milne as Alfred, Ed Speleers as Jimmy, Jim Carter as Mr. Carson and Rob James-Collier as Thomas in the Edwardian drama. (Photo: Nick Briggs for Masterpiece)

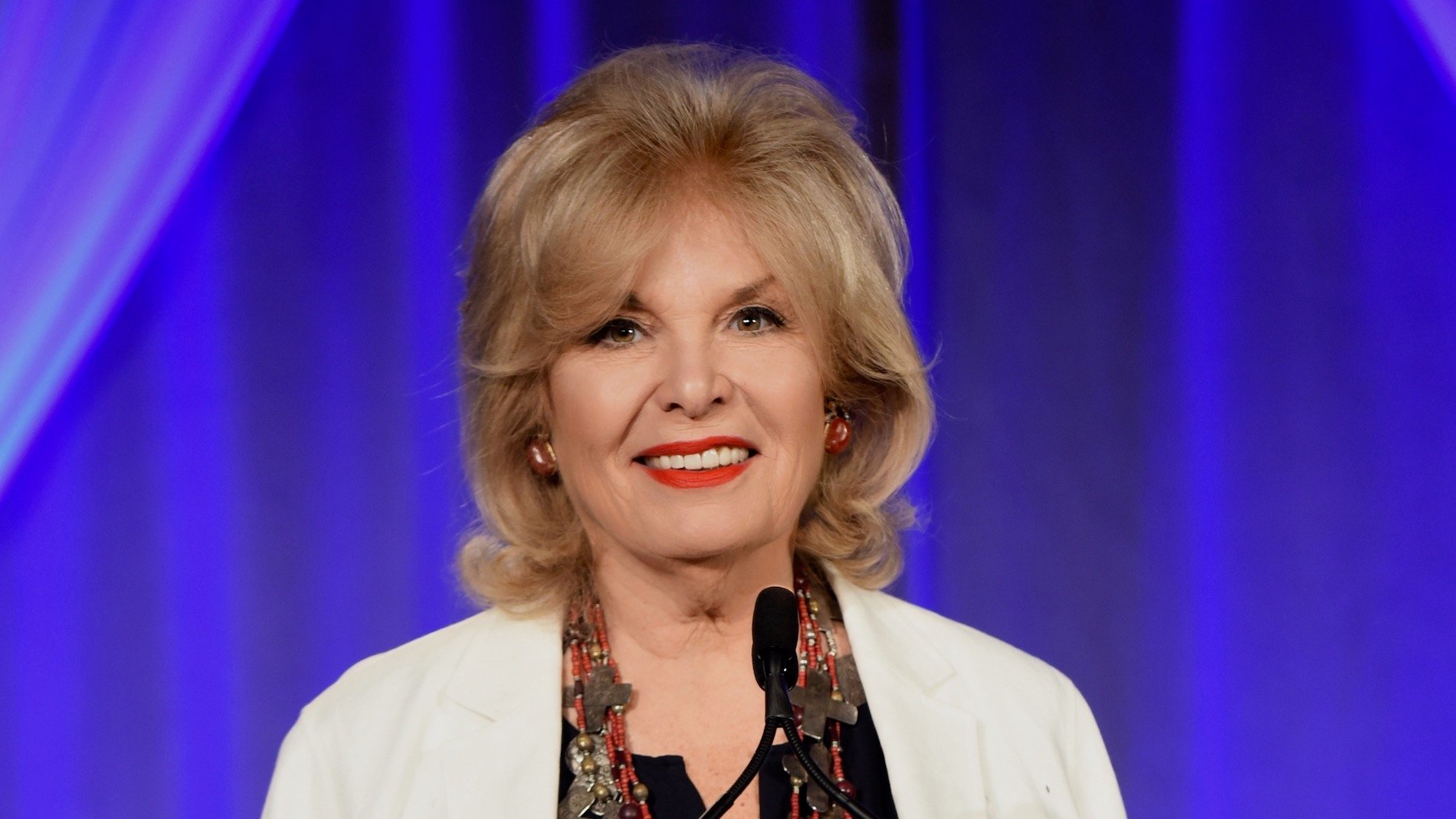

Earnings generated by distribution deals for the hit drama Downton Abbey once again brought in much of the extra revenue, along with ancillary revenues from PBS Kids’ properties, short-term investment gains and reimbursements for overhead costs tied to grants. Molly Corbett Broad, chair of the PBS Board’s finance committee, announced the positive financial results Nov. 6 at a PBS Board meeting.

The meeting, at PBS headquarters in Arlington, Va., was the first of the network’s new fiscal year and marked the beginning of a new board term for directors elected or re-elected to new terms. In addition to electing a chair and two vice chairs, directors were briefed on PBS’s expanded efforts to diversify its content, workforce and audience.

In reporting on PBS’s exceptional financial performance, Broad cautioned board members that the network and its member stations face many big-ticket expenses in the year ahead, including planning for the PBS Next Generation Interconnection System, unknown costs associated with the FCC’s television spectrum auctions and repacking process, and potential new investments in PBS’s next strategic plan.

As it did last fiscal year, the board unanimously approved a recommendation to divide the surplus three ways: $10.5 million to be invested in PBS content; $8 million in the Roadmap to the Future Fund, a board-managed fund that supports initiatives such as system sustainability and arts programming; and $6 million in the Digital Content Initiatives Fund.

In a series of votes to elect leaders, the board approved a one-year extension for Chair Geoffrey Sands, a director of McKinsey & Co. who will continue serving as a general director and board chair beyond the expiration of his board term.

Sands joined the board in 2006 and was first elected chair in 2009. By remaining in the board’s top leadership post, Sands will help provide continuity to PBS governance as several long-serving directors depart, said WGBH President Jon Abbott, chair of the nominating and corporate-governance committee.

Elected as vice-chairs were Malcolm Brett, g.m. of Wisconsin Public Television, and Don Baer, c.e.o. of the communications firm Burson-Marsteller.

Each member of the board’s leadership team received unanimous approval in voice votes.

Directors stepping down after completing two consecutive board terms include Broad, president of the American Council of Education, who departs after chairing the finance committee and serving as a general director board vice-chair. Fred Berens, managing director of investments at Wells Fargo Advisors in Miami, is also departing.

The board also heard, in public and closed executive sessions, reports on PBS’s efforts to expand its service to minorities and diversity its workforce. Sands announced that he had expanded the scope of work for a diversity task force so that it will operate as an advisory committee to the board. The committee will evaluate PBS activities targeting diversity in content, employment, vendor contracts and governance, Sands said.

Don Boswell, president of WNED in Buffalo, N.Y., will chair the committee; Helen Hernandez, founder of the Imagen Foundation, a Hispanic-advocacy organization, is vice chair. They will make their first report to the board at its January meeting.