After a hard year, NBR investor brings in new management

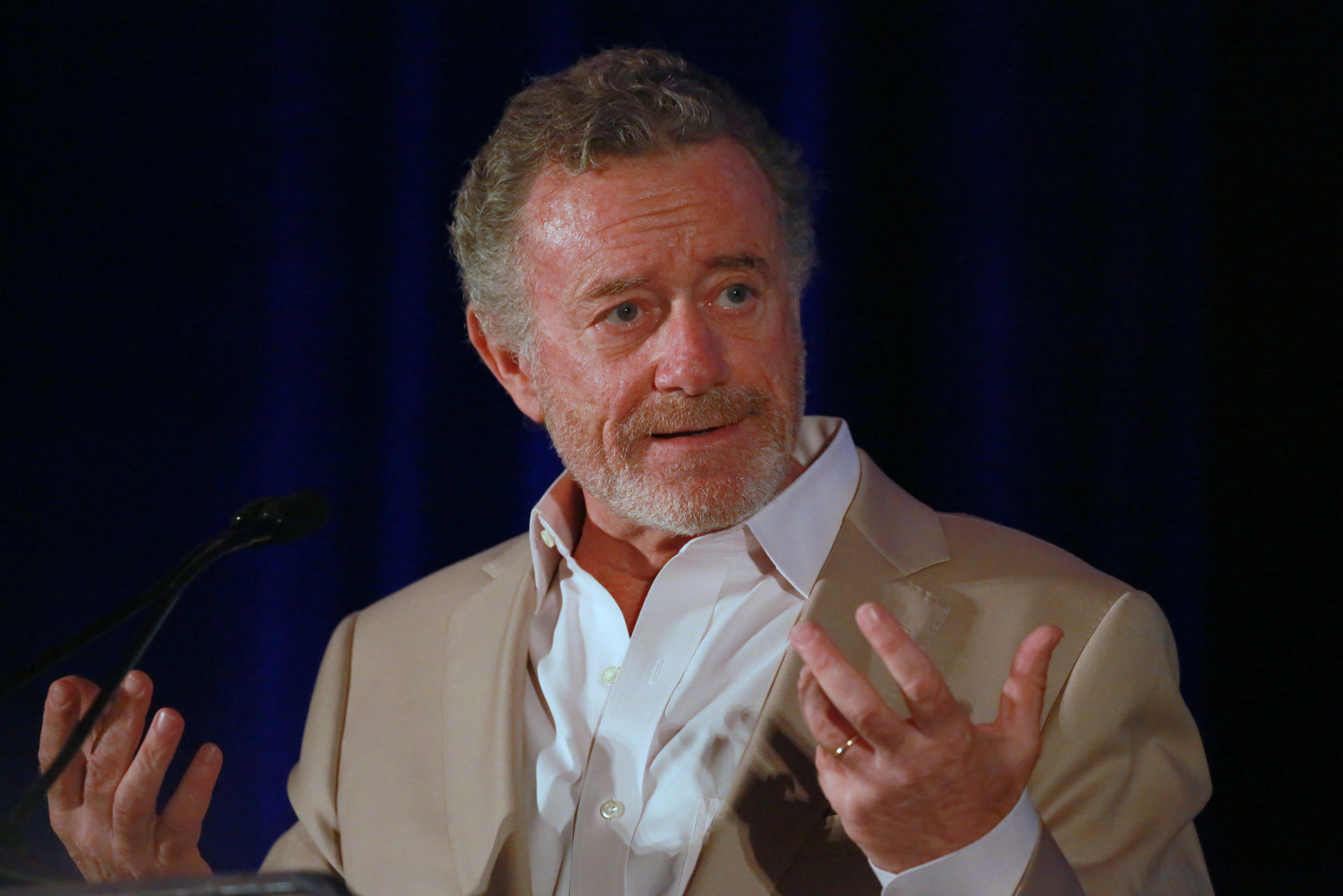

Rick Ray considered purchasing public TV’s Nightly Business Report earlier this year but last week ended up as its new c.e.o. instead.

Atalaya Capital Management, the New York venture-capital firm that ended up owning the show, was shopping it around in March, said Ray, a veteran media executive who built cable syndicator Raycom Sports.

He took a look, was intrigued and spoke with Atalaya. But the timing for a deal wasn’t right at that point, Ray said; he was too busy with several other projects.

He took a look, was intrigued and spoke with Atalaya. But the timing for a deal wasn’t right at that point, Ray said; he was too busy with several other projects.

“But I liked what I saw” in NBR, Ray said. He got back in touch with Atalaya within the past month to check on the status of the sale, “and they said, ‘Funny you should ask! Would you like to get involved?’” He talked some more with Atalaya, “and it became apparent what could be done with the show” if Ray took a leadership role.

So he did, as announced Nov. 16 by the show’s production company, NBR Worldwide: Ray is now the company’s c.e.o., and Atalaya, which backed Mykailai Kontilai’s purchase of the show a year ago, came out as the owner.

While the press release characterized Atalaya’s transaction as an acquisition, the investor “has been involved from Day 1,” Ray said. “More or less, it’s a change in management.”

The previous chief exec, Kontilai, a former educational-video salesman who formed NBR Worldwide to purchase the show from its longtime producer, Miami’s WPBT, in August 2010, said in the press release that he was celebrating “the realization of many of our short- and long-term goals.” But for the most part, he and partner Gary Ferrell, one-time president of KERA in Dallas, are no longer involved. Kontilai and Ferrell “have made themselves available to us as consultants,” Ray told Current, “and we might use them from time to time.”

Kontilai did not respond to requests for an interview.

In 2008, the show’s producing station, WPBT, brought in Jim Russell, former Marketplace e.p. and now a production consultant under the brand of The Program Doctor. Russell examined the widely carried half-hour show, which was by then 29 years old.

“The show hadn’t had a major update, which it needed,” Russell said. He gave NBR a “thorough, intensive analysis,” flying to its New York and Washington offices and checking in with Chicago by phone.

“The whole staff got involved,” Russell said. “We rethought the entire show, it was exciting. Everything was on the table. And everyone seemed to like the ideas.” But WPBT also seemed “unwilling or unable to make staff changes or cutbacks,” Russell said. “Also, despite a desire to modernize the show, the station seemed rooted in an older way of doing things.”

The show had not flourished as channels proliferated and new business shows popped up and while the recession sapped corporate desire for advertising and underwriting. NBR had one longtime underwriter, Franklin Templeton, and could secure only short-term commitments from Exxon Mobil, Wells Fargo and Mercedes-Benz.

Meanwhile, between October 2009 and October 2011, its nightly viewership has dropped significantly.

From 2005 to ’09, PBS was contributing $2.6 million, or 35 percent of the program’s total revenues of about $7.3 million, according to a source with former ties to the program. But in July 2010, PBS cut its annual support in half and told the show its support would end this year. At the same time Franklin Templeton reduced its contribution by 30 percent, citing sagging audience numbers.

WPBT sold the show to Kontilai within a month.

When Kontilai took charge, Russell briefed him on his previous work with the client. Kontilai liked several ideas, Russell said, including Executive Editor Rodney Ward’s suggestion of putting NBR on SiriusXM satellite radio — which came to pass this May.

But Kontilai, who had never before worked on a journalistic venture, had lukewarm success with other plans to bolster the show and its image. On his watch, NBR announced the opening of four “bureaus,” in Houston, Phoenix, Denver and Silicon Valley.

However, “the word ‘bureau’ may be misleading,” said Ted Simons, host of the Horizon public affairs show on Arizona PBS in Phoenix, who was identified in an NBR press release as its “managing editor” leading the “Phoenix bureau’s editorial team.” Simons said the Phoenix newsroom provided one story a month to NBR, three minutes or shorter, “and that’s pretty much it.”

Another initiative touted repeatedly by Kontilai, a Defense Department contract to provide individual finance education to the military, never materialized, nor did international distribution partnerships for the show or a new website. And no additional long-term underwriters came on board.

Though Kontilai didn’t heal NBR’s woes, WPBT and PBS hadn’t either. By bringing in Atalaya, Russell says, Kontilai “saved the program, which was not going to survive financially.”

But the show’s survival came at a cost: Thirteen of 44 staffers either quit or were laid off since Kontilai’s arrival, including longtime top newsroom executives Wendie Feinberg and Ward, and Howard Grossman, the veteran New York show director and senior photographer.

Television financial news “is a brutally tough industry,” said Larry Moscow, former e.p. of Wall Street Week with Fortune on PBS and now a partner with maslansky luntz + partners, a strategic communications firm in Washington, D.C. “Nightly Business Report has the benefit of a significant legacy audience developed with its well-deserved reputation,” he said. “A lot of people involved are experienced, seasoned financial journalists. To break through to a bigger audience, it needs to be innovative and creative — because eventually a legacy audience goes away.”

“The business of journalism”

So Ray faces ongoing challenges on multiple fronts.

He comes to NBR with an eclectic background in commercial broadcasting. In 1979, Ray and his wife, Dee, founded Raycom Sports, which produced and distributed college football and basketball games for the Atlantic Coast and Big Ten conferences as well as the now-defunct Southwest Conference. In 1993, Ellis Communications, an Atlanta-based consulting and investment firm focused on media and technology, purchased Raycom Sports. Ray’s company ultimately grew into Raycom Media, an employee-owned network with 46 television stations in 37 markets and 18 states.

Ray retired from Raycom in 1995 and has since worked on several projects, including For Race Fans Only, a NASCAR show that ran on the QVC shopping network. His current interests include developing a program on cybercrime (“All about the perils of the Internet, people getting ripped off, Internet scams,” as he described it) and a reality show about a family cigar business.

Ray said Atalaya is cognizant that a news program is a unique investment and not within its expertise. (Atalaya declined comment to Current through a spokesperson.) “They understand they don’t know the business of journalism,” Ray said. “They are investors and want to leave everything to news professionals to see things grow as they should.”

He said Atalaya inserted a clause into his contract guaranteeing him full editorial control of NBR, “and I have ceded that control to the editorial staff.”

Editor & Publisher reported in December 2009 that when Atalaya acquired the alt-weekly newspaper chain Creative Loafing after its bankruptcy that August, “it packed the board with experienced newspaper executives” including former Los Angeles Times Editor Jim O’Shea.

Ray is also the new chair, as of Nov. 17, of Victory Management Group, a Charlotte, N.C., public-relations firm that is rebranding Nightly Business Report, according to a Victory press release.

For Ray to play both of those roles “is at the very least untraditional,” said Jeffrey Dvorkin, executive director of the Organization of News Ombudsmen, who served as NPR’s first ombudsman in 2000. “For any journalistic operation to be credible, it needs to have very clear lines separating editorial from business. If it’s now being mashed up, it probably doesn’t augur well with how Nightly Business Report will survive.”

Ray told Current that as he manages the program as well as its rebranding, he will respect the strict wall between editorial and marketing functions that exists in news operations. “Nightly Business Report is editorially very sound, they do a good job with that,” Ray said. “But in the past, the show hasn’t had much support in the marketing area.” His relationship with both the production and marketing companies “will allow us to grow the brand and still maintain separation.”

Ray also invests in broadcast and cable programming through his firm Nuray Holdings in Savannah, Ga., and serves on the advisory board of the Miami-based NewsProNet, a creator and syndicator of short-form video news for commercial TV stations and websites; major clients include MSNBC.com and stations owned and operated by CBS.

Ray sees ancillary revenue opportunities for NBR in the media business, such as a content-distribution deal for international outlets — something Kontilai had hoped to do. “He was working on it,” Ray said. “I hope what I bring to the table is enough experience to execute his good ideas.”