Pubcasting finds itself put ‘in play’ — briefly

When public broadcasters awoke on Jan. 23 [1995], they saw the headlines and their heads started spinning.

Newspapers reported that Bell Atlantic [later renamed Verizon] was interested in a partnership with CPB “that would have the Baby Bell step into the funding role now played by the federal government,” as the Wall Street Journal put it. That news came from Sen. Larry Pressler who revealed on CBS’s Face the Nation that the company and other telecom firms were interested in buying or partnering with public broadcasting after Congress privatizes it.

To people who thought they understood media economics, it made no sense. Had the fundamental economic incentives of TV changed that much? Or the politics?

Within hours after Pressler’s remarks, the situation spiralled into a parody of a Wall Street feeding frenzy from the buyout-crazed 1980s. Public broadcasting seemed to be “in play.”

Glenn Jones–head of the eighth largest cable operator, Jones Intercable, and the Mind Extension University, a competitor of the PBS Adult Learning Service–saw Pressler on TV and fired off a letter to Pressler the next day asking not to be left out of any opportunities. Later, a Jones spokesman said: “There’s no plan, there’s no proposal.”

The operator of the Discovery Channel also showed interest. The company said it had described to legislators and to PBS a plan for public TV to become a second-run outlet for programs carried first on its cable networks.

The headline in the Washington Post was ” ‘Vultures’ Circle Public TV,” based on a remark by Maryland PTV President Raymond Ho.

To top it all, a small Baltimore nonprofit, Supporters of Public Broadcasting Inc., put on a straight face and offered $1 to take over NPR, with promises that it could run the network without federal aid within five years.

The feeding frenzy couldn’t last. By the day after the broadcast, Bell Atlantic was telling the New York Times that it hadn’t been lobbying on the idea, hadn’t seriously evaluated the investment and had discussed it only casually. The company didn’t know that Pressler would discuss the topic until shortly before airtime, when an aide to the senator called a Bell Atlantic lobbyist, spokesman Eric Rabe told Current.

“This was one of the issues that came up in the context of a wide-ranging discussion of telecommunications issues,” Rabe told the Times. “They asked us, ‘Would you guys have interest here, if we changed the laws?’ Our answer was that we might be interested in a couple of ways.” One would be to buy programs from public TV. The other would be to buy stations in areas where the company provides phone service.

It appears, however, there was little serious corporate interest in becoming sugar daddy to public broadcasting, though Pressler’s attempt to attach corporate credibility to his privatization notion did gain attention for it.

The senator asserts that public broadcasting programs could remain much the same with corporations providing the money that Congress now gives CPB, and he has advised CPB to draw up plans for that kind of future.

Pressler spoke with Bell Atlantic officials once or twice the week before he went on TV that Sunday, said Rabe.

NPR President Del Lewis, a former Bell Atlantic executive, said he heard from a company officer that the senator had visited with the “chairman’s conference,” a large group of more than 150 senior executives. (Lewis said he personally had nothing to do with the meeting, and had sent NPR-member stations a statement to that effect.)

Telephone executives were looking at the question because the senator asked them to, Lewis said. Pressler chairs the Commerce Committee, which is pushing historic legislation that will remake both the phone and cable industries. “It would seem to me that the commercial interest would be looking at the telcom legislation and want to be very cooperative,” Lewis observed to the Washington Post.

Lewis said he pointed out to Bell Atlantic leaders that privatization of CPB “makes no sense” because it has no assets to privatize, and they explained that they did not want to “get into the middle of a public broadcasting subsidy question.”

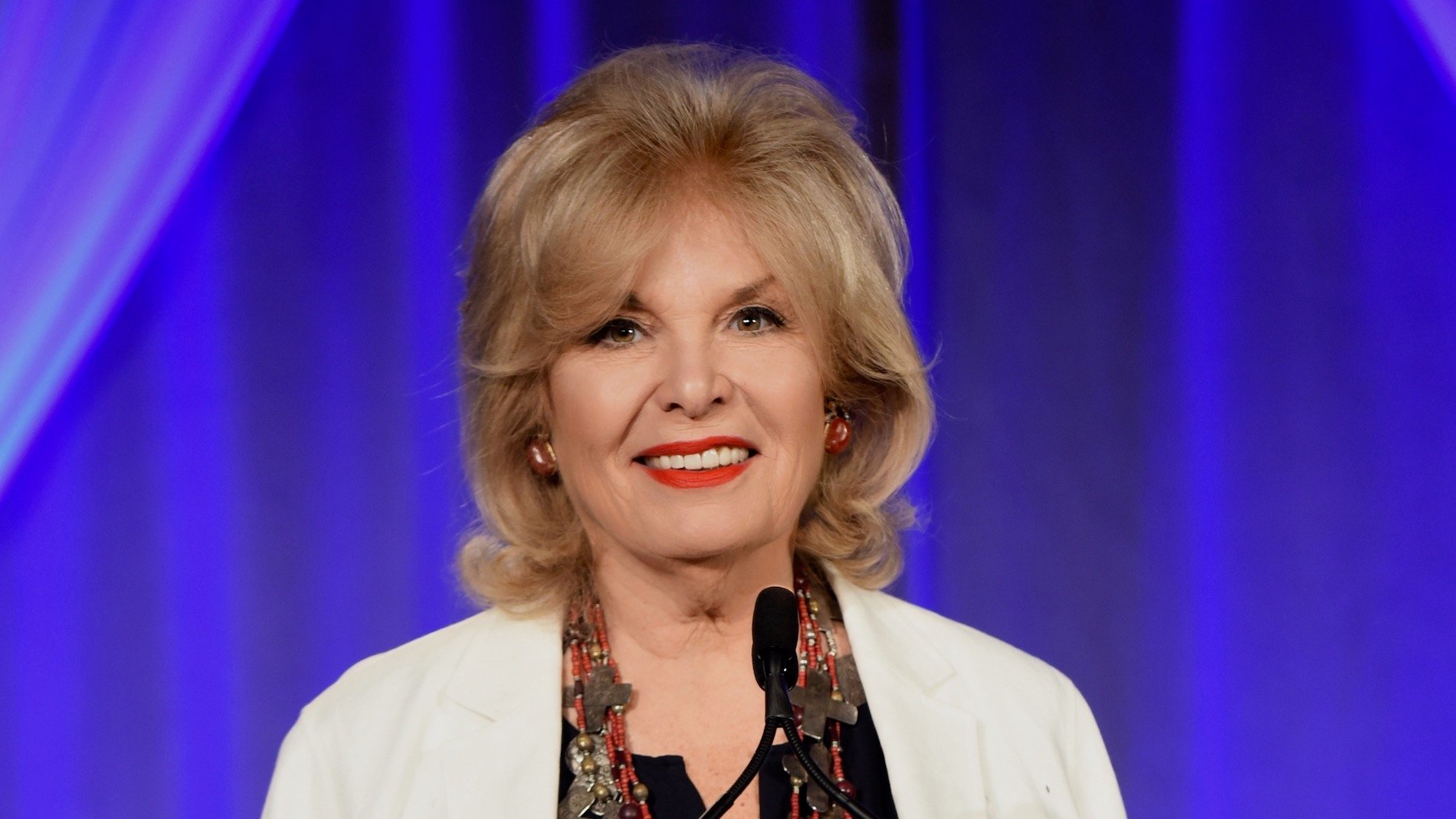

Pressler “mischaracterized” Bell Atlantic’s interest, said Bernadette McGuire, research director of America’s Public Television Stations. She said the company is interested in partnerships with PTV and sharing of programs. “I do not paint them as any kind of villain,” she said. “They are kind of caught up in this.”

She pointed out that Bell Atlantic had backed out of the highly touted merger with TCI when the cable giant’s profit outlook soured. “If TCI didn’t turn a profit acceptable to them, I don’t think CPB’s going to.”

A telecom industry consultant familiar with Bell Atlantic said he believed the company had been talking seriously with Pressler about possible links to public TV. “My sense is that Larry Pressler, who is largely a buffoon, didn’t know how to articulate it and basically prematurely disclosed the negotiations,” said the consultant. “Pressler just ***** blew it.”

The view from Pressler

The senator, who said Jan. 24 that privatizing public broadcasting “is one of my top goals,” hasn’t spelled out how his privatization would be financially feasible or capable of producing public-interest programs, and his staff didn’t return phone calls from Current. But Pressler has asked CPB to come up with a plan. “Let’s see a serious restructuring plan from CPB and the leaders of public broadcasting,” he wrote to CPB.

Pubcasters who questioned his proposal were “alarmists who profit from the current scheme” and “profiteers,” he said in a Senate floor statement Jan. 24.

The senator sketched his plan in broad outline. When CPB is privatized, he said in the floor statement, “the private company would step into the role now played by the federal government.” The sale agreement “could include conditions that children’s programming and rural broadcasting would be continued.”

He said a little more in a Morning Edition interview Jan. 27. “I think that public radio serves a very good purpose, but I think public radio would be much better off” if CPB were “either owned or operated as a partnership by a private business,” he said. “I’m advocating that the nature of public radio would stay about the same. The nature of public TV would, depending on changes in what’s happening in this world.”

As one condition of the new arrangement, Pressler said, “You would have some of the profit-making programs … subsidize the others.” CPB apparently would back programs and also “continue their subsidy to the states,” the senator said. “Of course, the states could decide for themselves what they wish to do.” CPB would get its income from “programming rights” paid by producers who now get “a free public platform for Barney, Sesame Street, Bill Moyers, Rukeyser, Frugal Gourmet . . .” He said a private corporation would get a “much higher percentage” of their proceeds than CPB gets.

“There would not have to be any more commercials than there are now,” he told Edwards.

Bell Atlantic also hadn’t done any studies to show that a private takeover of CPB could work financially, but spokesman Eric Rabe noted, “Sen. Pressler seemed to think it was entirely possible … to increase advertising on public television stations.”

Discovery offers a deal

Discovery Communications, meanwhile, proposed “creative coproduction arrangements” that would give the first play of programs to its Discovery Channel and Learning Channel viewers and a later window to PBS for viewing by the rest of the public, according to spokesman Jim Boyle.

“We would be willing to put up the majority of funding for projects we would mutually agree upon and would request the first window,” said Boyle. “PBS would be able to have programming available to its viewers subsequently,” days or weeks or months later depending on the nature of the shows.

Discovery, which plans to start three cable nets this year, specializing in science, history and how-to programs, has a big appetite for programming. Boyle noted that programming used on the new channels would be fresh for most viewers because the channels won’t be widely carried at first.

The cable networks need to take the first run, he said, because advertisers want first-run programming and a cable operator “wants to show the value of subscription programming you can’t get anywhere else.”

Of course, public TV tries to make the same point to its supporters.

By far the smallest supposed bidder for public broadcasting was a Baltimore company, Supporters of Public Broadcasting, with its $1 bid for NPR. While Bell Atlantic may have been surprised to find itself in the news, Supporters President Ed Graham jumped in head first. He got his offer into the aggressively conservative Washington Times on Jan. 27 (“Private group offers to take NPR off hands of taxpayers”).

Del Lewis said he didn’t understand Graham’s offer. “I’m not so sure how serious such an offer is. We’re not for sale.”

Graham said he also took his case to Pressler’s staff, on Jan. 26. He complains that pubcasters have stonewalled him on his plan to start an African-American network, that CPB doesn’t really want to offer programming to “minorities and less-educated segments of the population” as he does, and that his proposal to the CPB Radio Program Fund was rejected. His second proposal for a $600,000 CPB grant is pending.

Pressler picked up on Graham’s line of argument and pursued it in a half-dozen questions in his 16-page inquiry sent to the press and to CPB last week.

“Please explain the rejection of a grant proposal by Supporters of Public Broadcasting Inc. to provide the Public Radio Service as a competition to NPR,” Pressler asked CPB Chairman Henry Cauthen. “In light of CPB’s own research stating that the African-American community is underserved by network public radio, why has Supporters of Public Broadcasting not been funded to implement this project?”

Watch your back

The interest in acquiring public broadcasting assets was familiar to Raymond Ho of Maryland PTV. “This reminds me of the early ’80s when the independent stations were trying to form the Fox network,” says Ho, who then headed Arkansas ETV. “I was asked to go to a dinner meeting where I was being offered several millions if we would trade Channel 2 in Little Rock for the less desirable Channel 16. We refused the temptation even when we needed the money.”

Some defenders of public TV took the buyout story quite seriously. Newsday columnist Lars-Erik Nelson speculated Jan. 26 that the privatizers in Congress could “dump public television’s lucrative broadcast licenses on the market, where a far-sighted entrepreneur like [Rupert] Murdoch could snap them up at fire-sale prices.”